San Francisco kicks off 2026 with explosive price growth

Quick Take:

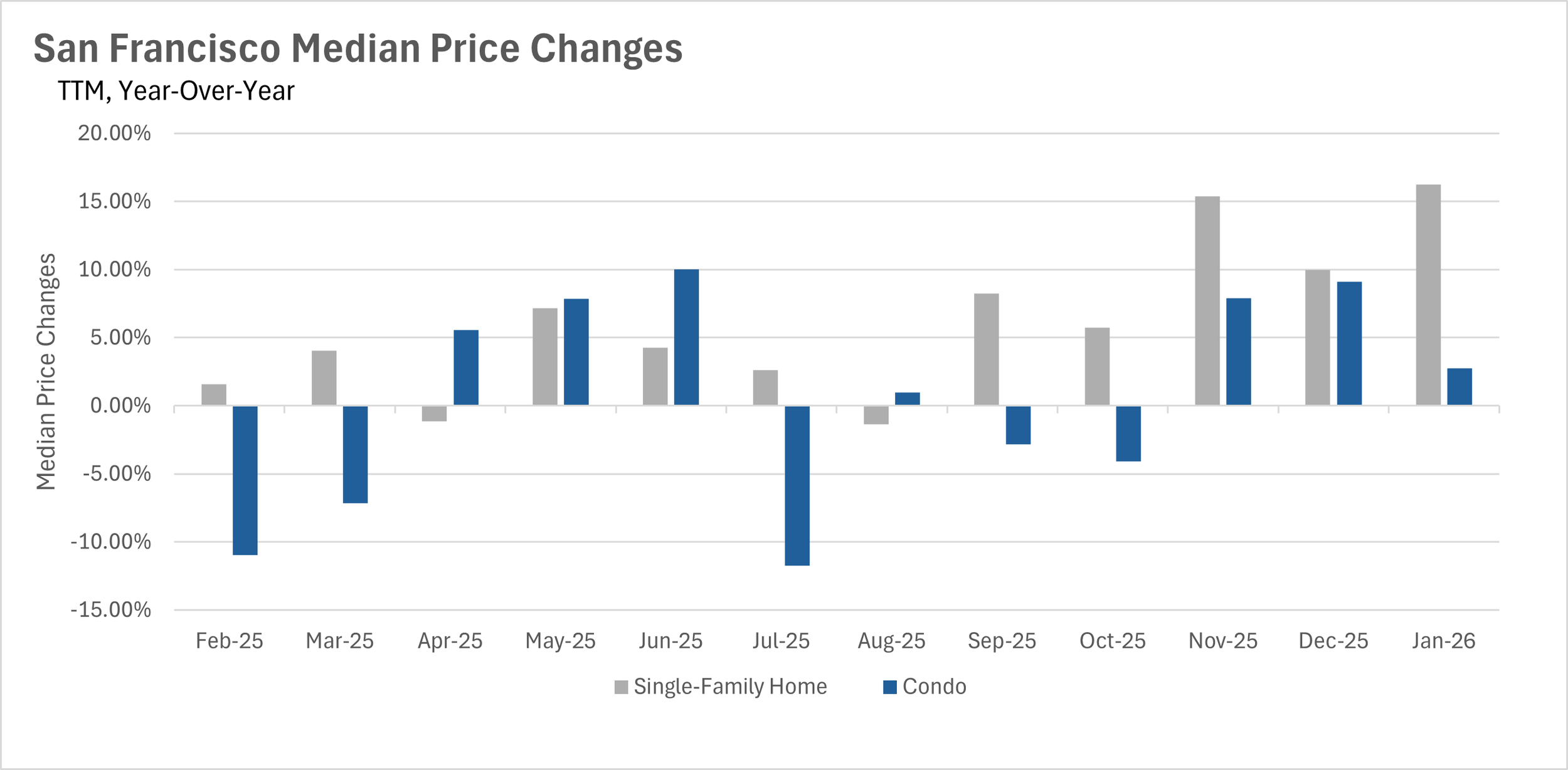

Single-family home prices surged by more than 16% year-over-year, marking one of the strongest January performances in recent memory.

Inventory levels remain severely constrained, with total listings down nearly 40% compared to last year.

The average single-family home is selling in just 13 days, more than half the time it took last January.

San Francisco kicks off 2026 with explosive price growth

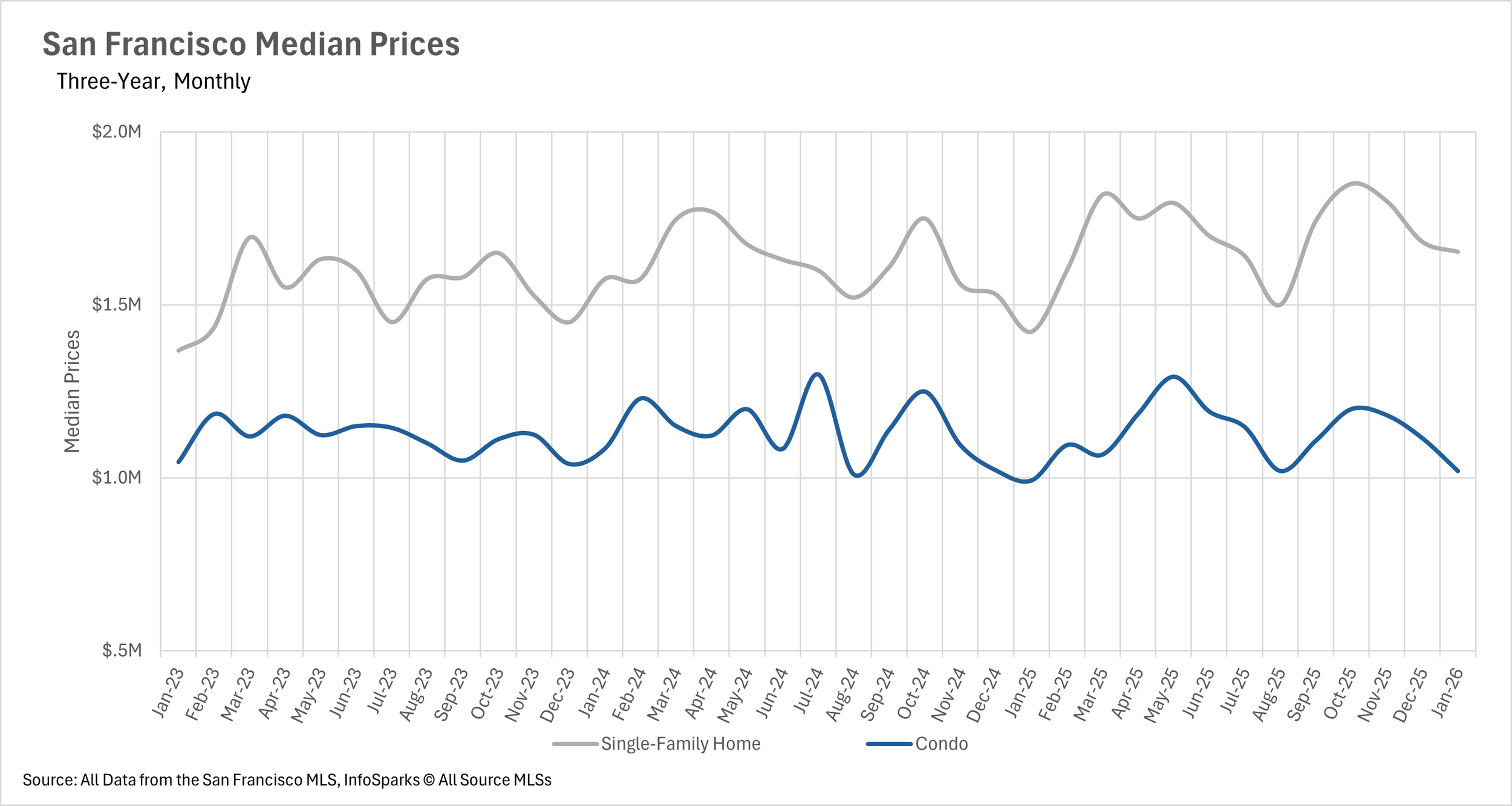

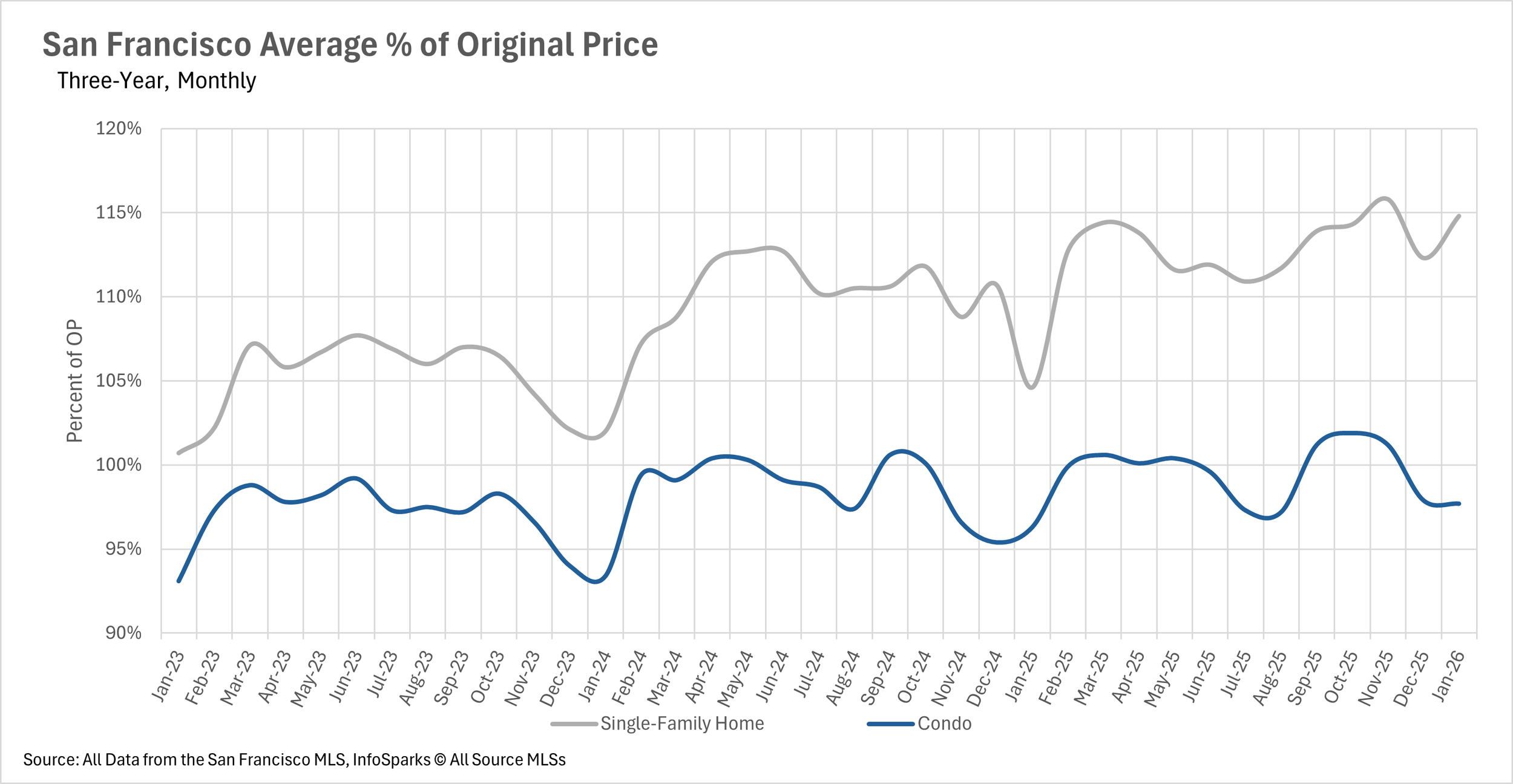

San Francisco's housing market roared into 2026 with remarkable year-over-year price appreciation. Single-family homes saw a stunning 16.23% increase in median sale price, with the median home selling for $1,653,325. Condos also posted gains, with the median sale price rising by 2.77% to $1,020,000. The demand for single-family homes remains exceptionally strong, with the average home selling for nearly 15% over the original asking price. Meanwhile, condos are selling at a slight discount, closing at 97.7% of list price on average.

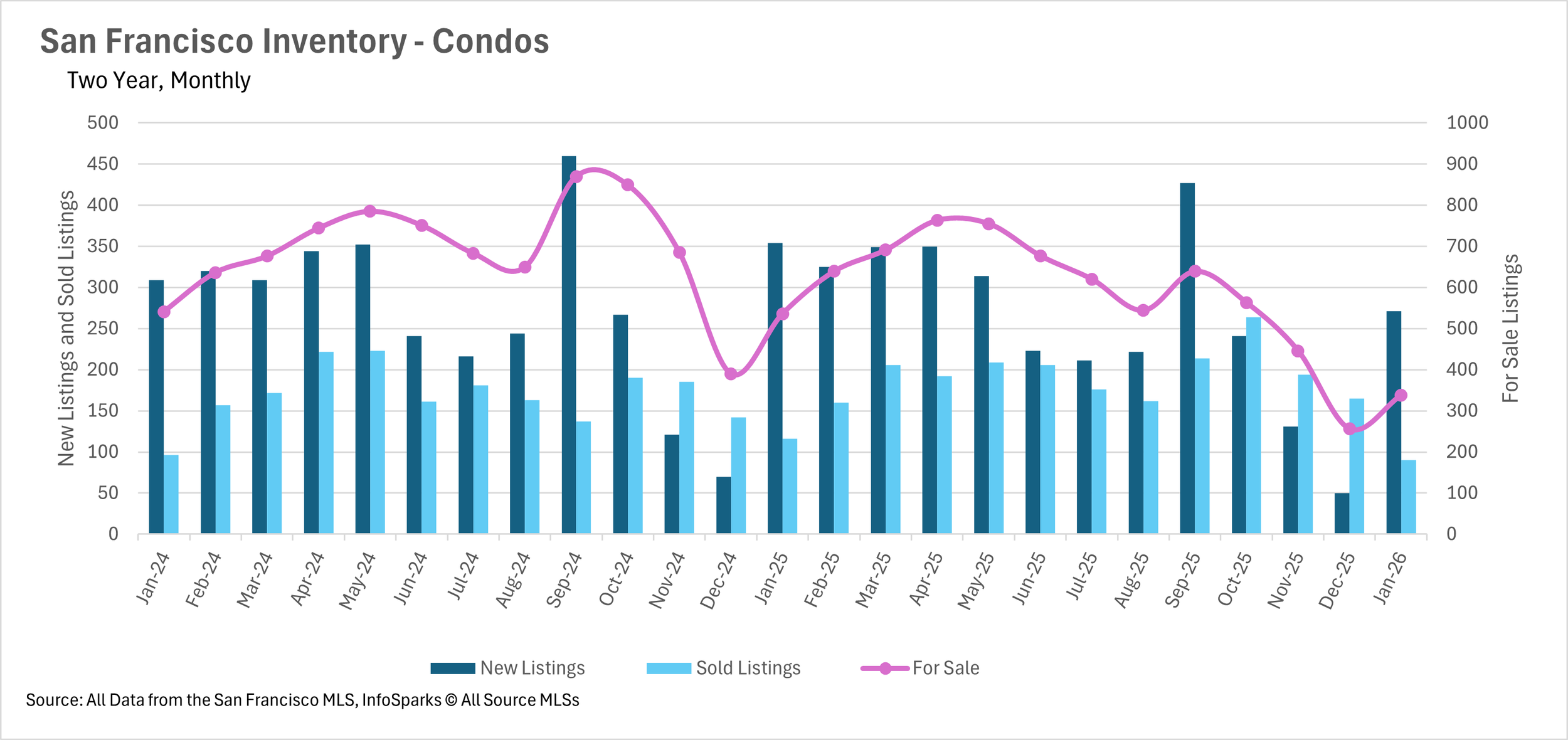

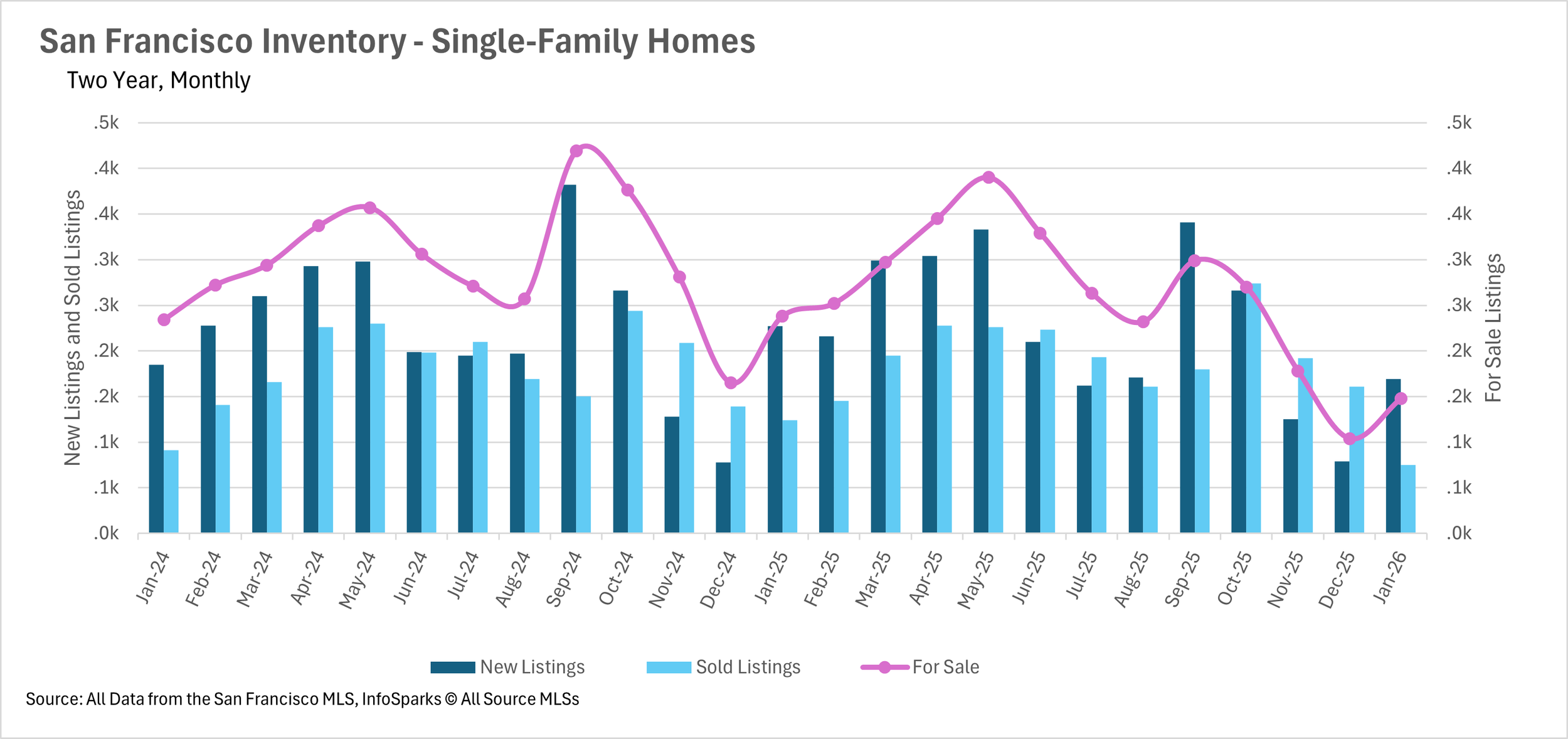

Inventory remains at critically low levels across San Francisco

The inventory shortage that defined the end of 2025 has carried over into the new year. There are currently just 148 single-family homes for sale in San Francisco, representing a 37.82% decline compared to January 2025. The condo market is facing similar constraints, with inventory down 36.94% year-over-year to just 338 units. Combined, there are fewer than 500 homes available for sale in the entire city. While new listings did pick up from December's lows, the market remains starved for inventory, and buyers continue to face an extremely limited selection of properties.

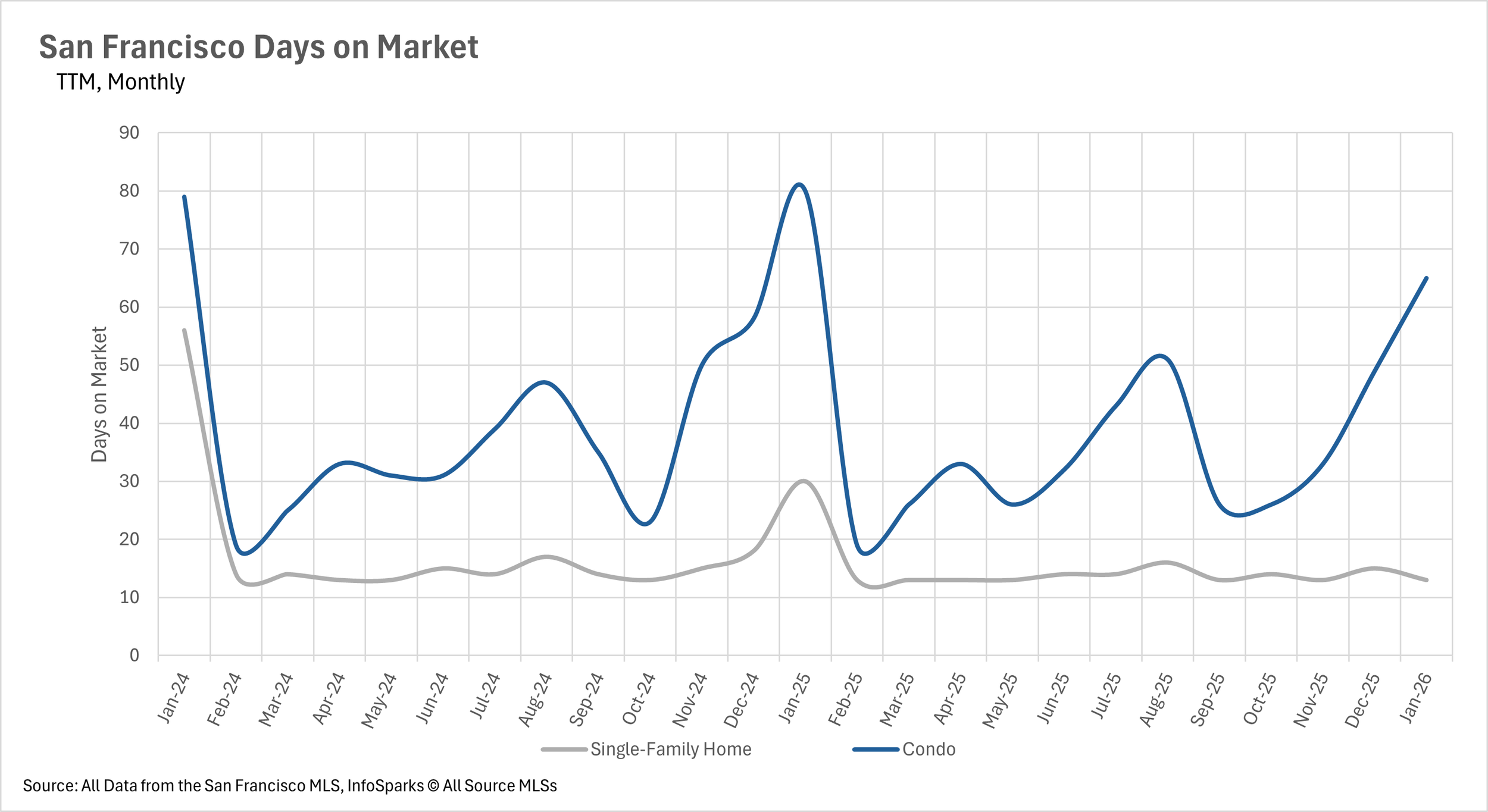

Single-family homes are selling at a blistering pace

The severe inventory shortage has created an incredibly fast-moving market, particularly for single-family homes. The average single-family home is selling in just 13 days, representing a 56.67% decrease compared to last January when homes sat on the market for 30 days. Condos are also moving more quickly, with the average condo selling in 65 days, an 18.75% year-over-year decline. For single-family home buyers, this means there is virtually no time to deliberate before making an offer, and competition for desirable properties remains fierce.

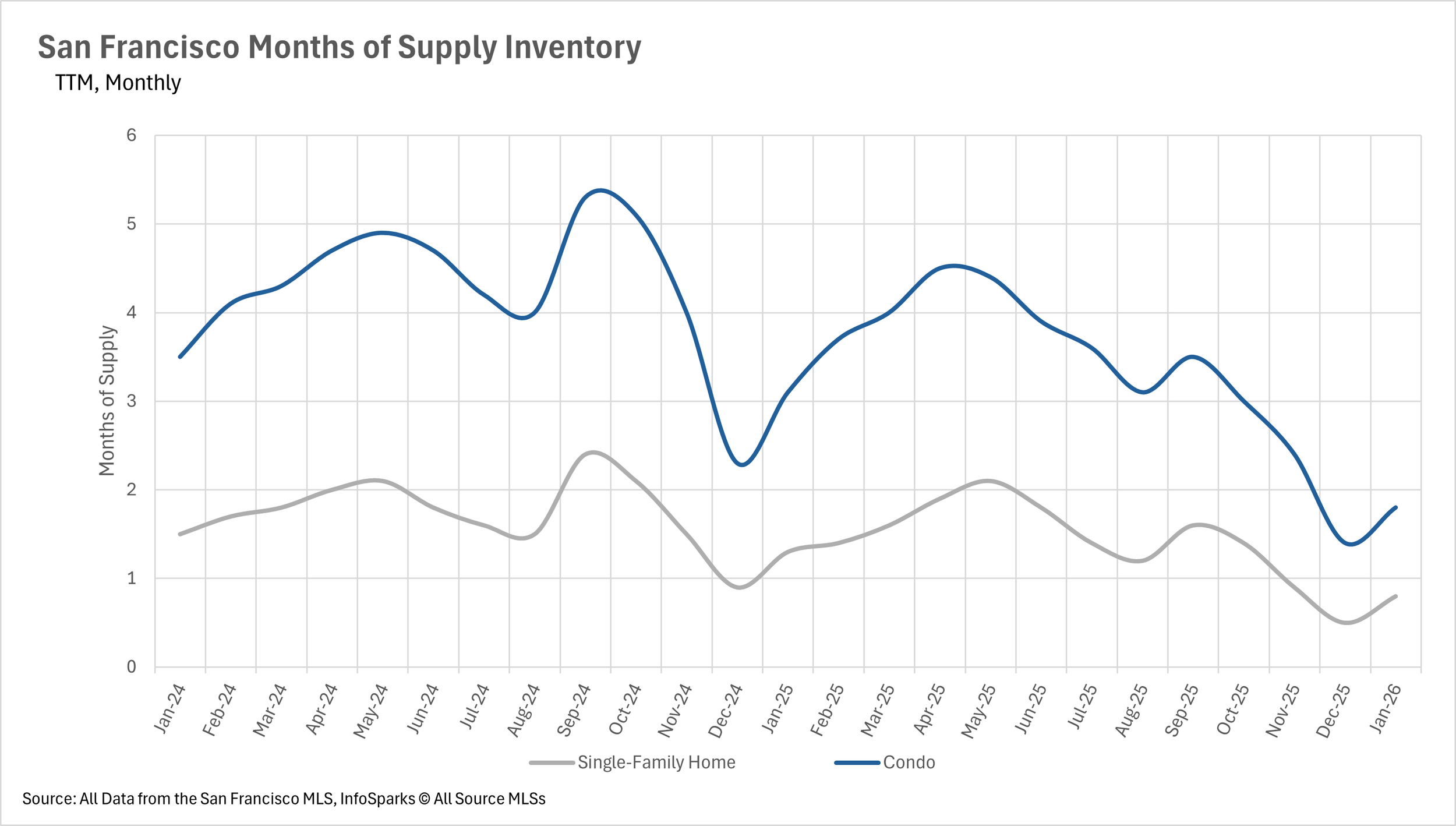

San Francisco remains firmly entrenched in seller's market territory

When determining whether a market is a buyers' market or a sellers' market, we look to the Months of Supply Inventory (MSI) metric. The state of California has historically averaged around three months of MSI, so any area with at or around three months of MSI is considered a balanced market. Any market that has lower than three months of MSI is considered a seller's market, whereas markets with more than three months of MSI are considered buyers' markets.

With just 0.8 months of single-family home inventory and 1.8 months of condo inventory on the market, the entire San Francisco market remains a strong seller's market. Both property types are well below the three-month threshold, giving sellers significant leverage in negotiations. Until substantial new inventory enters the market, buyers will continue to face stiff competition and limited options throughout San Francisco.