Vantage Realty Market Update - June 2025

What the Numbers Are Telling Us

As of mid-June, the housing market continues to navigate the aftermath of higher mortgage rates, shifting homeowner behavior, and mixed economic signals.

Mortgage Rates remain elevated at 6.81%, unchanged from last month. While this is historically moderate, it still feels high compared to the sub-3% rates many homeowners locked in just a few years ago.

Loan Origination Volume has dropped sharply—down nearly 80% from the 2020–2021 peak—as buyers adapt to the new cost of borrowing.

Inventory is Rising: U.S. single-family home supply rose 32.7% year-over-year, now back in the pre-pandemic range. More options could ease pressure on buyers, though inventory is still tight in many markets.

Homeowner Tenure Hits New Highs: The average American stays in their home for 8.12 years, a record high, with California homeowners holding on even longer thanks to property tax protections under Prop 13.

Bay Area Jobs Slip Again: The region lost another 4,900 jobs in May—its fourth monthly loss this year—while the state overall posted slight gains.

Unemployment Holds Steady at 4.2%, but economic uncertainty lingers amid a Q1 GDP contraction and elevated household debt.

Sellers Motivated by Life Changes: A majority of sellers (79%) are moving out of necessity—not financial gain—with life events like family needs or relocation driving decisions.

San Francisco Home Prices rose 3.2% in May to a median of $1.75M, while condo prices jumped 10% to $1.29M. Inventory remains low for single-family homes (2.14 MSI), keeping it a seller’s market, while condos (4.08 MSI) are edging toward balance.

San Francisco’s micro-markets are as diverse as its neighborhoods. While these numbers highlight key trends, they don’t capture the full story behind every property type or location. If you’re considering buying or selling, let’s connect for a tailored analysis of your home or your next move.

Mortgage Rates

As of June 15, the average 30-year fixed mortgage rate in the U.S. was 6.81%, unchanged from a month ago. That’s not high compared to the national averages seen in the last 50 years, but the market is still absorbing the shock of going from 3 to 7 percent in just the last two years. This chart from the Federal Reserve Bank of St. Louis (FRED) tracks rates from the 1970s to today, highlighting a peak above 18% in the early 1980s amid high inflation and Fed tightening. Rates then declined for decades, reaching historic lows below 3% during the 2020–2021 pandemic. Since 2022, however, rates have risen again—surpassing 7% in 2023—and remain elevated in 2025 compared to recent years, though still below historical highs. (Federal Reserve Bank of St. Louis

Loan Origination Volume

Fannie Mae loan volumes soared in 2020–2021 during the ultra-low rate era, peaking at over $1.4 trillion in loan originations. Since then, volume has plunged by nearly 80% as interest rates climbed—making 2024 one of the slowest lending years in decades. The key question: will Americans remain conservative or adjust to the new normal of higher rates? (Fannie Mae)

Housing Inventory Levels

U.S. housing inventory is on a clear upward trajectory. As of June 6, there are approximately 809,000 single-family homes on the market—a 32.7% increase year-over-year. Inventory levels are now back in the pre-pandemic range, showing a gradual recovery in supply which may ease some pressure on buyers and signal a shift in market dynamics. (Altos Research/HousingWire)

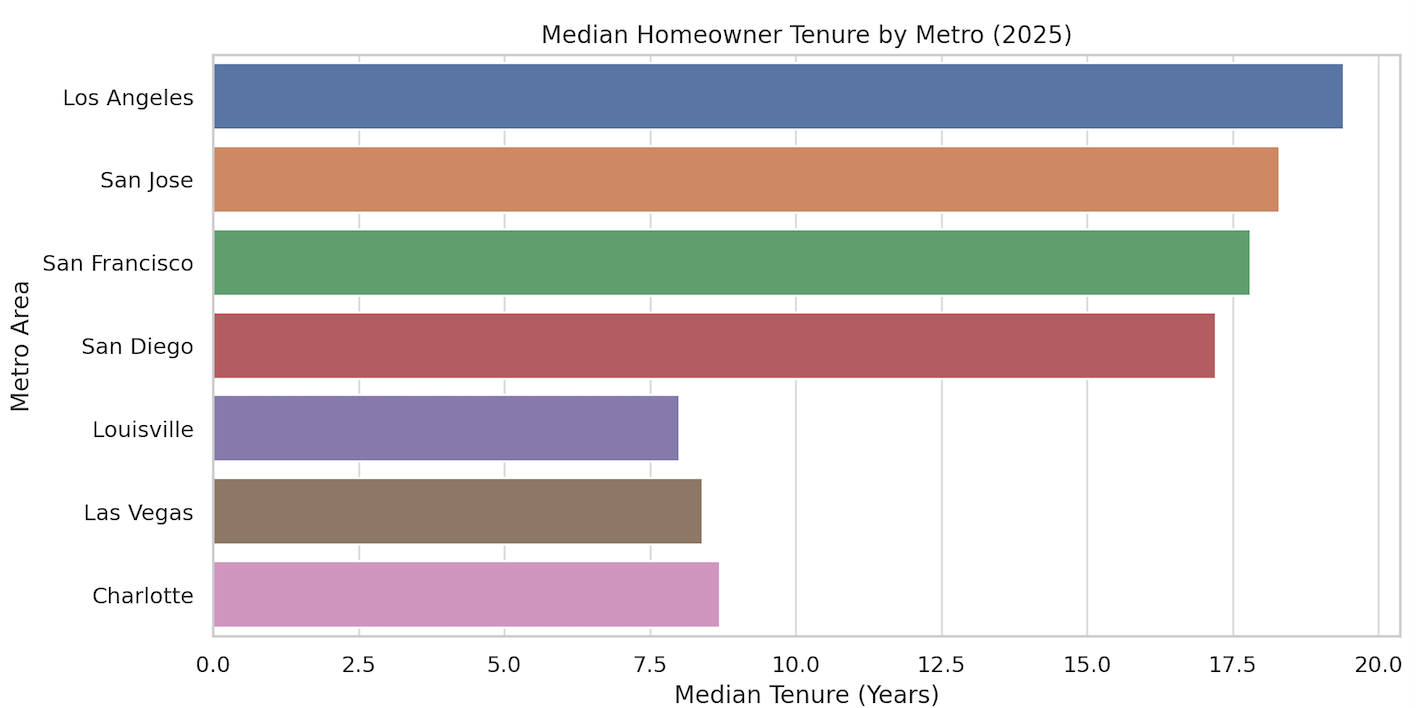

Housing Tenure

As more and more Americans are aging in place, the trend in homeownership tenure is on the rise. According to ATTOM, the average U.S. homeowner stays in place for 8.12 years, a new high. Just two years ago, that average was 7.4 years, and 10 years ago, that average was 4.5 years. ATTOM data scientists attribute this to a shift in homeowner behavior since COVID. But in California, homeowner tenure is even longer. Prop 13, which caps property tax increases, gives homeowners a strong financial incentive to hold onto their homes for decades. (Redfin)

Bay Area Jobs Watch

The Bay Area lost 4,900 jobs in May, marking its fourth monthly decline this year and bringing the 2025 total to 19,100 jobs lost, according to new data from the state’s Employment Development Department. While California as a whole posted modest job gains, most of the Bay Area’s major metro regions—including San Francisco, the East Bay, and Marin—saw job losses. The South Bay and Sonoma County were the only bright spots, each posting small gains, while Napa remained flat. All figures are seasonally adjusted. (EDD)

Unemployment Rate

As of May 2025, the U.S. unemployment rate held steady at 4.2%, unchanged from April, according to the Bureau of Labor Statistics. This marks more than a year of stability within the 4.0–4.2% range. Still, economic uncertainty is brewing. The U.S. economy contracted slightly in Q1—GDP dipped 0.3%—prompting renewed recession concerns. Contributing factors include global tensions, new tariffs, elevated mortgage rates, and record household debt. That said, some typical recession indicators—like rising jobless claims or sharp declines in consumer spending—have yet to materialize. (BLS)

Top 8 Reasons Why Homeowners Sell

Why are some homeowners willing to trade a low mortgage rate for a higher one? According to a recent Realtor.com survey, 79% of homeowners considering a sale are doing so out of necessity. And for most, the reasons are non-financial—think life changes like job relocations, family needs, or downsizing—not market-driven decisions. (Keeping Current Matters/Realtor.com)

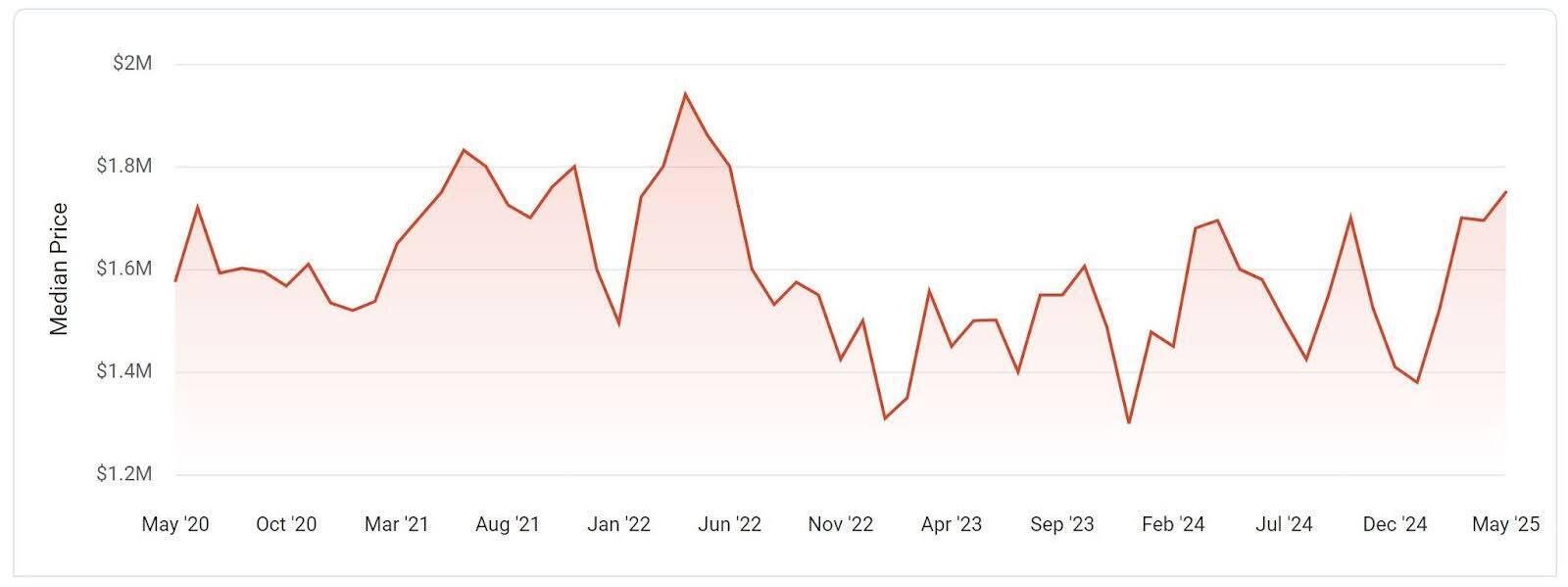

San Francisco Home Prices

The median sales price for a single-family home in San Francisco in May was $1,750,000, up 3.2% from April. Sales volume was down from the prior month by 2.6% to 225 home sales. The median days on market climbed month-over-month by 14.8% to 31 days. It’s important to note that the single-family home months’ supply of inventory, the amount of time it would take the current listings to be absorbed by the market, is 2.14, suggesting it is still a seller’s market. (Realtors’ Property Resource)

San Francisco Condo Prices

The median sales price for a condominium in San Francisco in May was $1,290,000, up 10% from April. Sales volume was up from the prior month by 3.8% to 193 condo sales. The median days on market climbed month-over-month by 11.8% to 57 days. It’s important to note that the condo months’ supply of inventory, the amount of time it would take the current listings to be absorbed by the market, is 4.08, generally suggesting a more balanced market. (Realtors’ Property Resource)