Vantage Realty Market Update - September 2025

September Market Update

Interest rates, AI, limited turn-key inventory, luxury condo sales — these themes keep surfacing at our sales meetings and Tuesday broker tours.

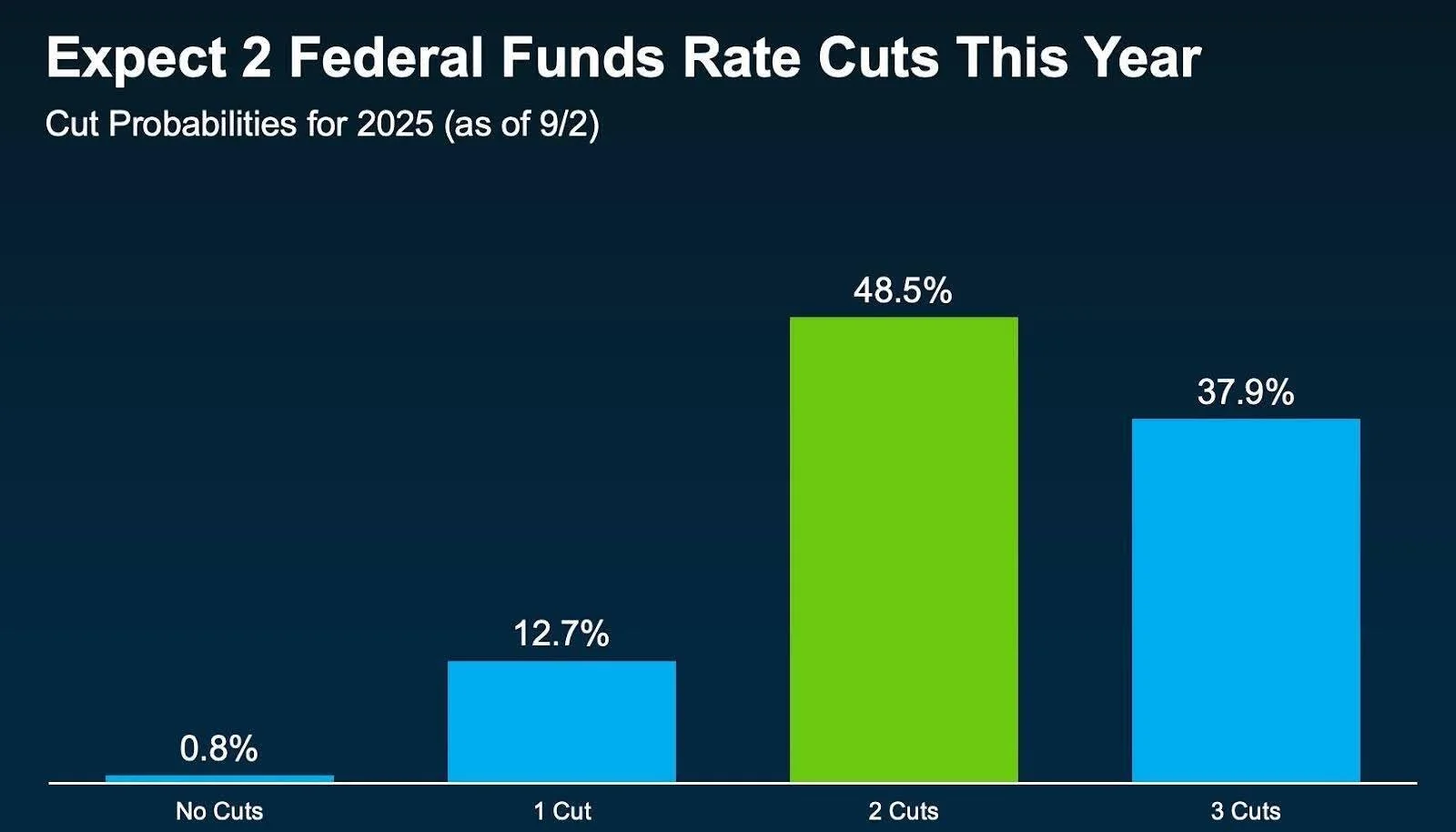

The Fed’s September rate cut, the first since December 2024, has set the stage for at least two more reductions ahead. Lower borrowing costs will draw more buyers back into the market — but here’s the catch: once rates hit that “magical” level, competition for the few perfect, move-in-ready homes will spike. Our advice? If you find a property that checks your boxes, don’t wait. Buy now, refinance later, and sidestep tomorrow’s bidding wars.

Meanwhile, San Francisco’s luxury condo market is heating up. Sales at 181 Fremont, the Four Seasons Private Residences, and One Steuart Lane are closing in the $7–10M range, as tech-driven buyers return to San Francisco. They’re drawn not only by the Bay Area’s AI-powered economy but also by its unmatched lifestyle. For sellers, this means preparing your homes for tomorrow’s tech-forward buyer — think integrated smart systems for climate, lighting, and more.

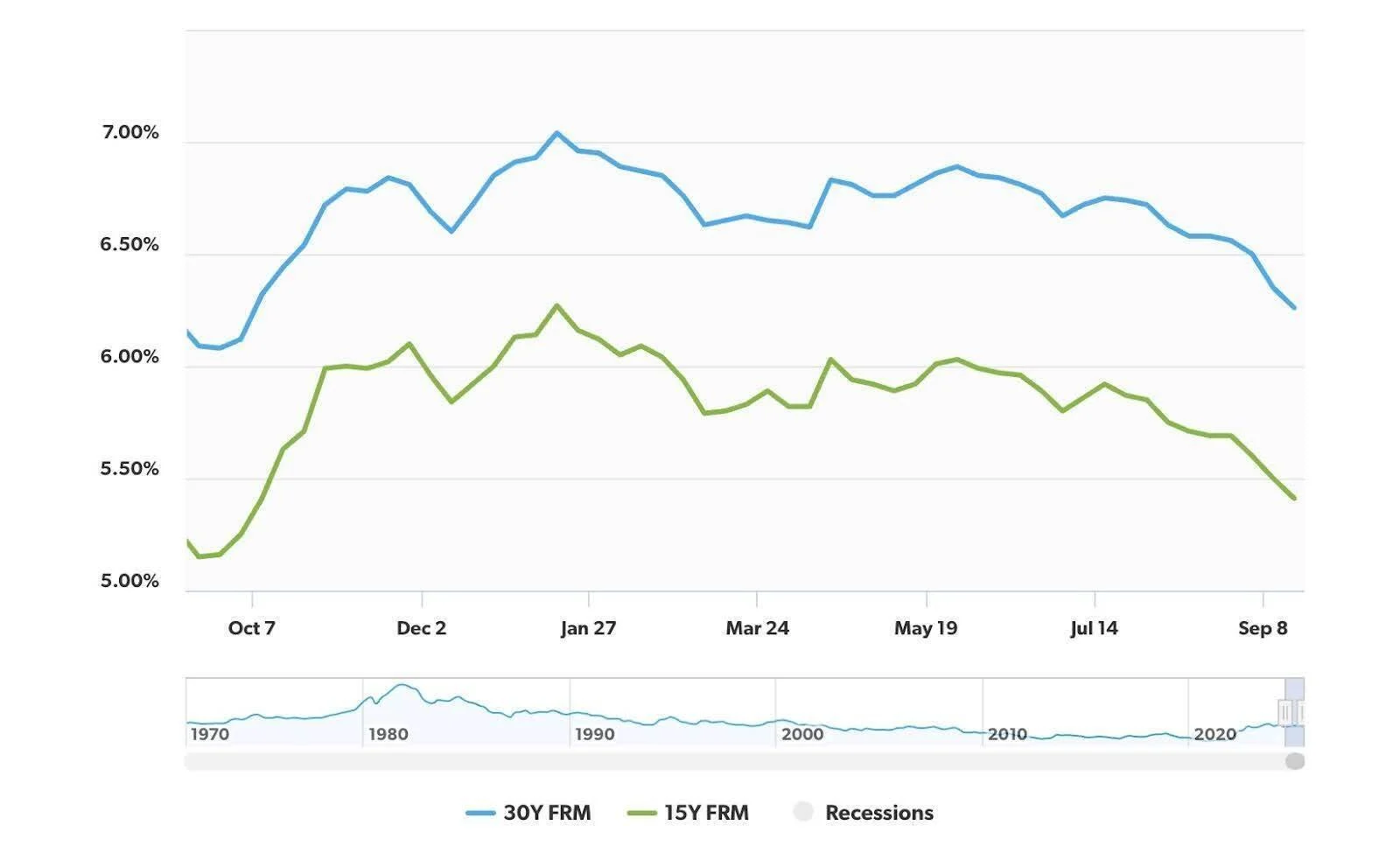

Mortgage Rates

These charts show U.S. mortgage rate trends through September 18 and the probability for further Fed rate cuts. The 30-year fixed-rate mortgage (30Y FRM) sits at 6.26%, while the 15-year fixed-rate mortgage (15Y FRM) is at 5.41%. The Federal Reserve cut its benchmark rate by 25 basis points on September 17, the first reduction since 2024. While the Fed doesn’t set mortgage rates, the cut, combined with a sliding 10-year Treasury yield, has helped push mortgage rates to their lowest level in nearly three years. For buyers and owners, this creates a timely opportunity to lock in lower borrowing costs or consider refinancing before market conditions shift again. (FreddieMac, CME Group, Keeping Current Matters)

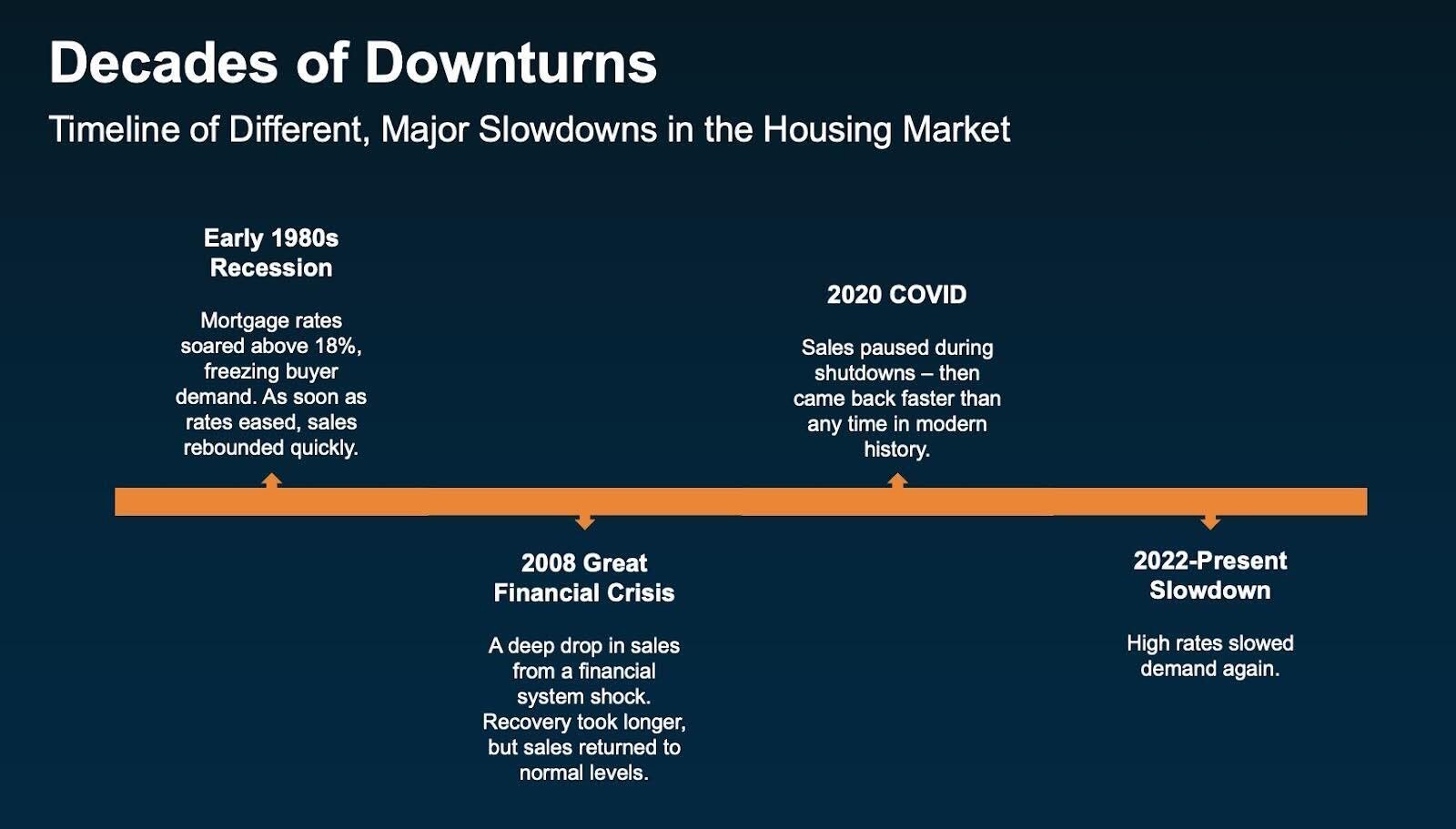

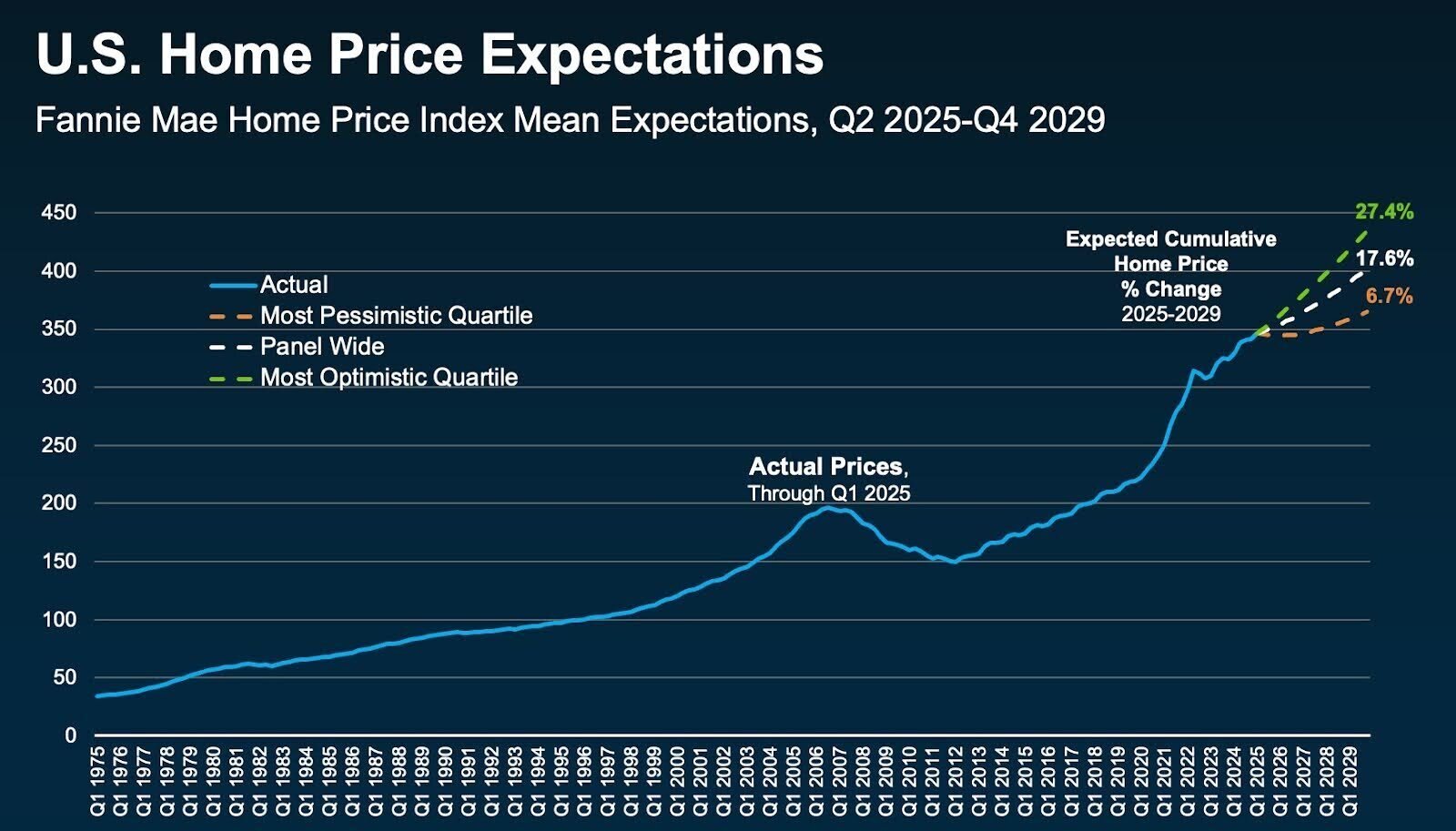

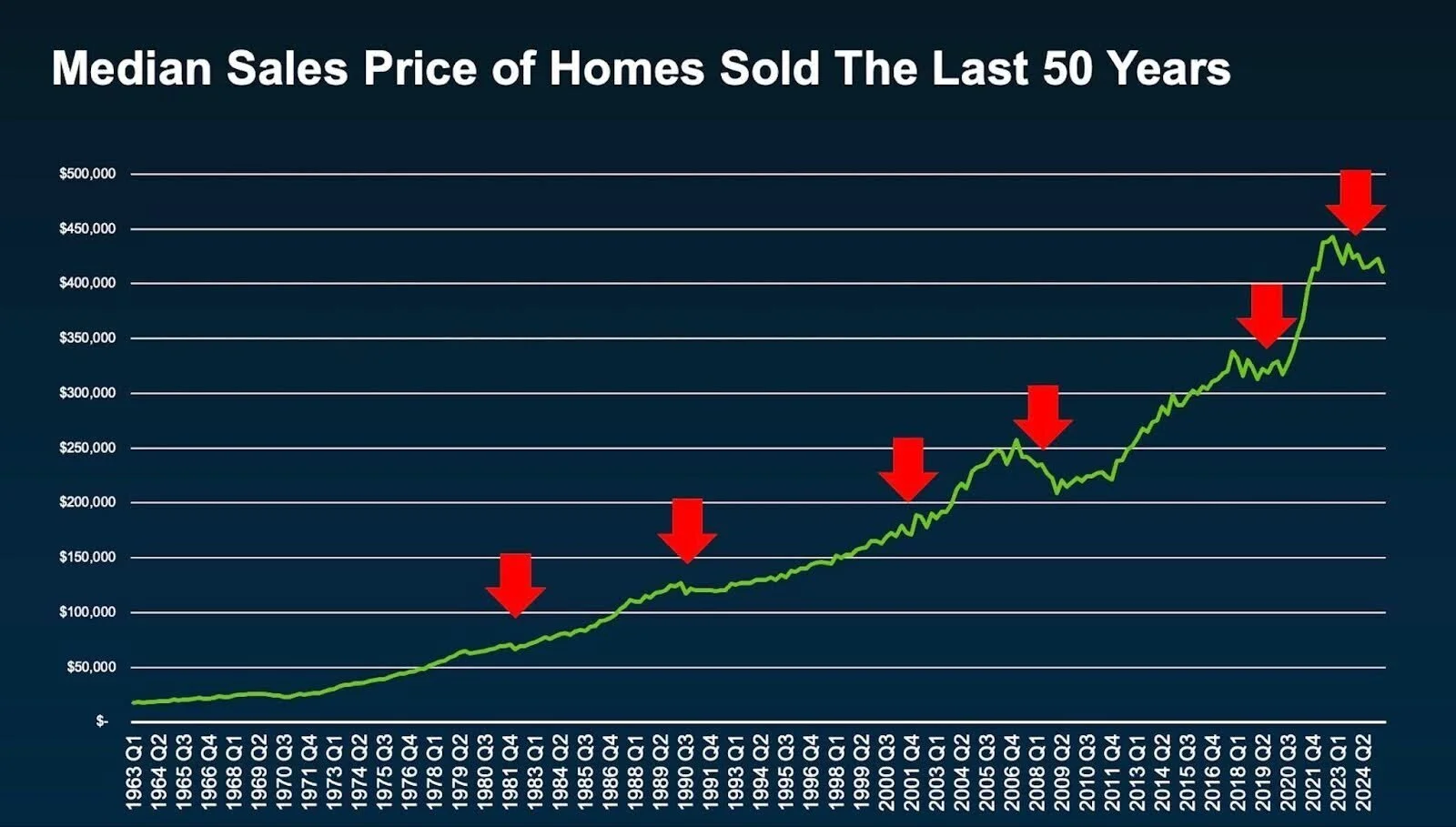

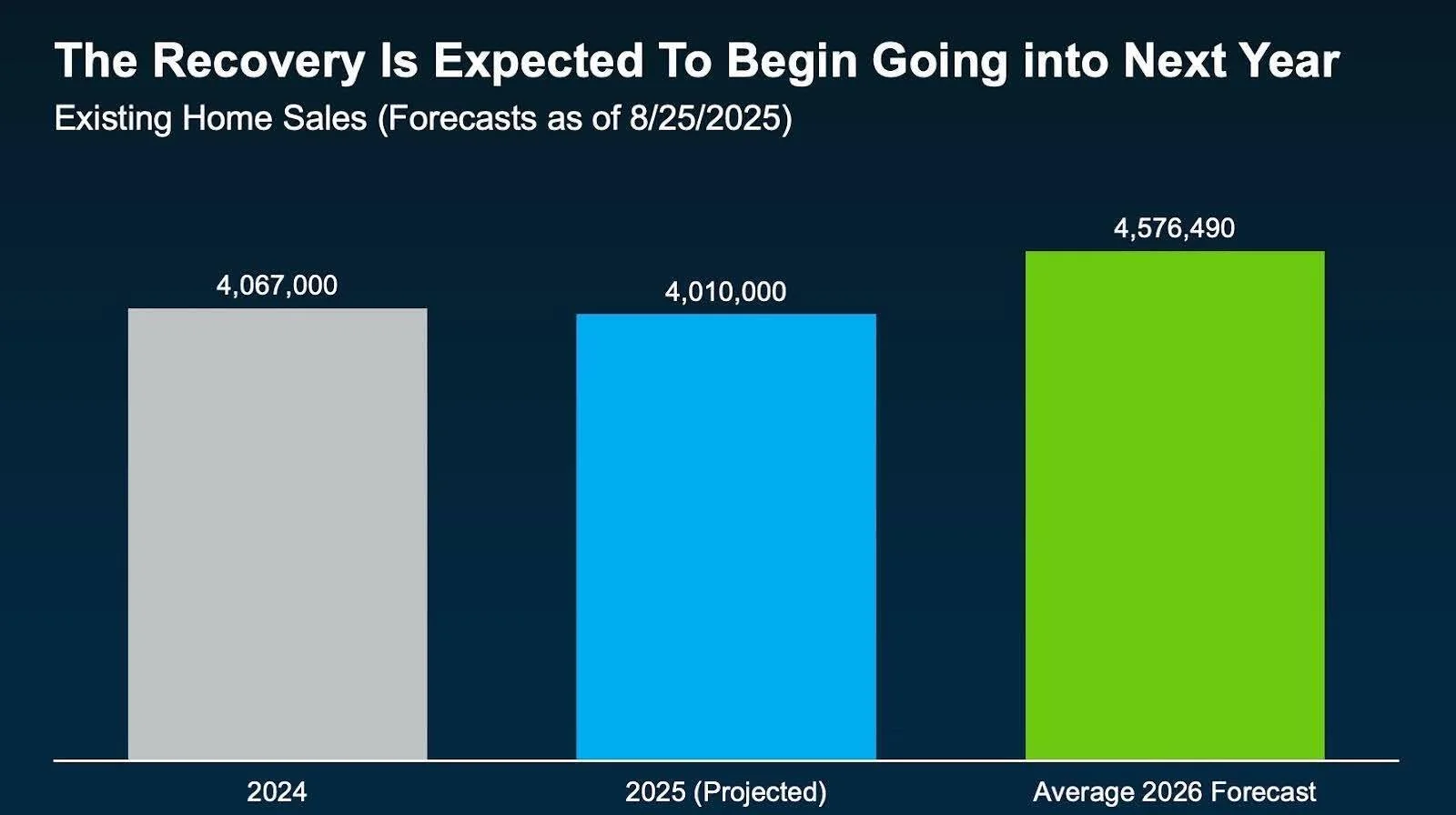

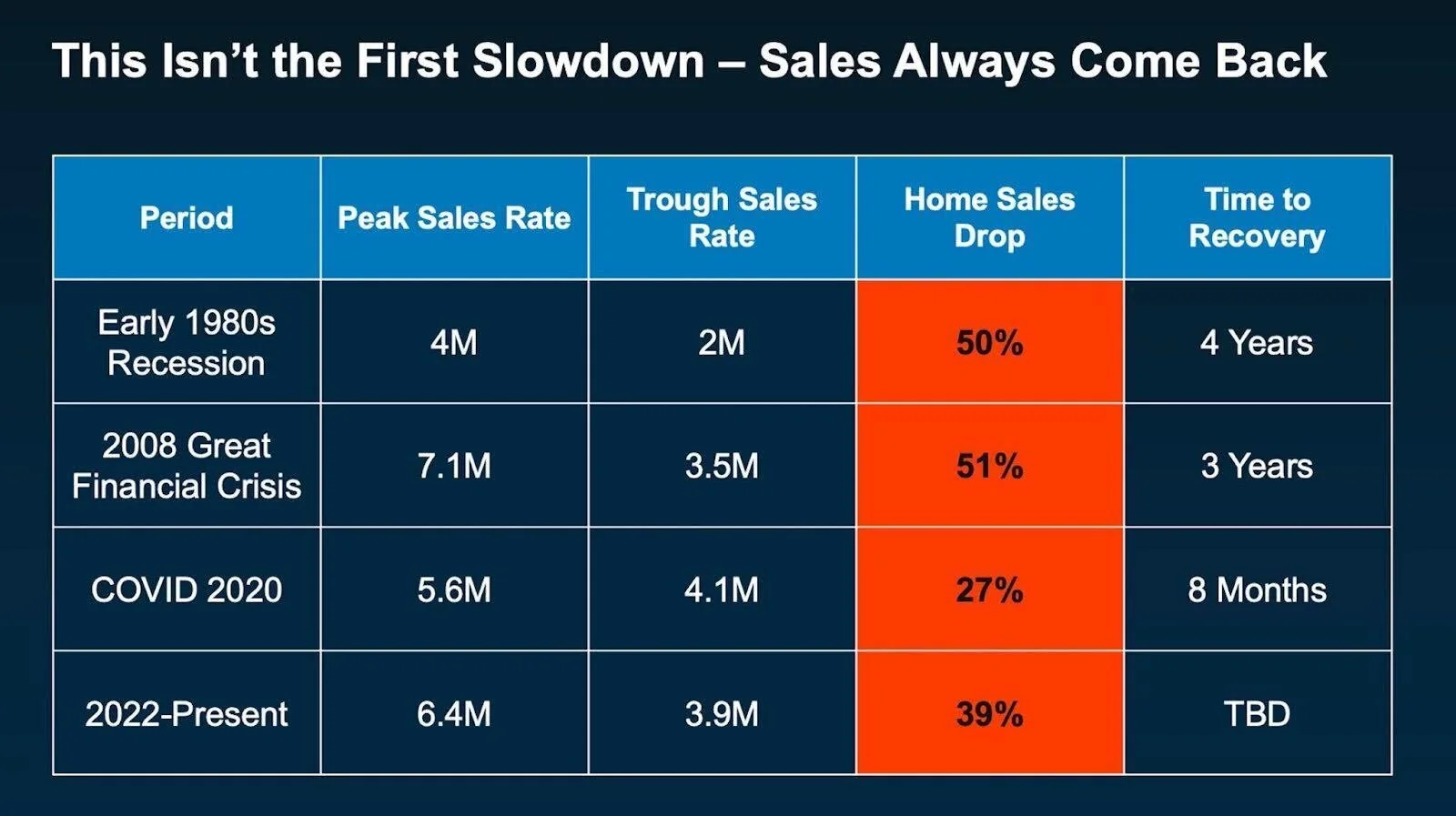

Every Downturn Ends in Recovery

The national housing recovery is expected to be certain, but slow, more like the long climb after 2008 than the quick rebound after the COVID boom. After the Great Recession, prices didn’t hit bottom until 2012 and didn’t pass their old peak until 2016—that kind of healing takes time. COVID was different: rock-bottom rates and remote work sent demand soaring and inventory to record lows, then higher rates cooled things back down. Looking ahead, think “thaw,” not “surge.” Lower mortgage rates are nudging more buyers and refinancers back in, but 2025 sales should be roughly flat before improving. On the supply side, inventory is inching up as builders finish more homes. Taken together, 2025–2026 should bring a steadier market as rates ease and listings normalize—more slow taxi than rocket launch. (Fannie Mae, CME Group, FRED, St. Louis Fed, KCM)

The San Francisco Numbers

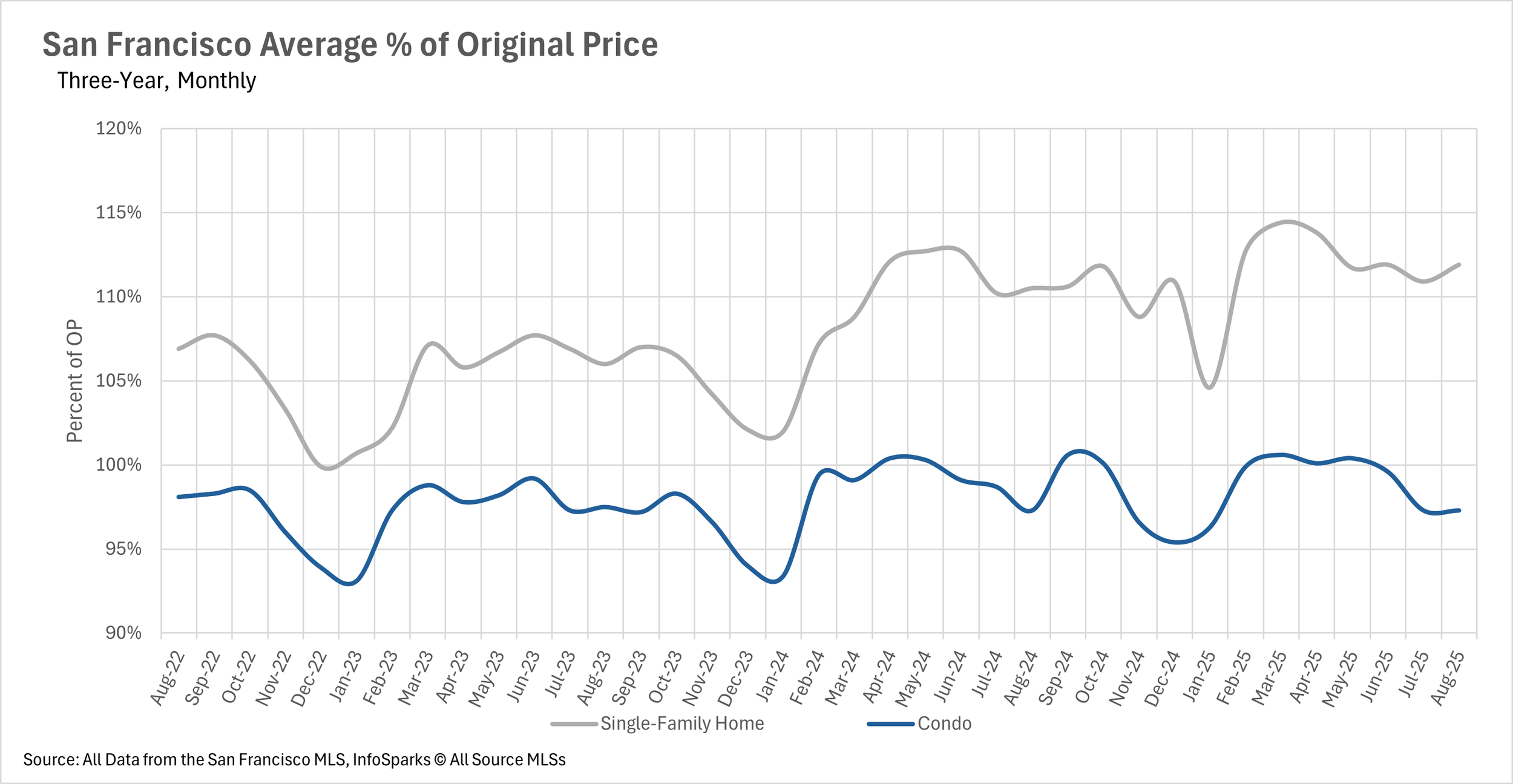

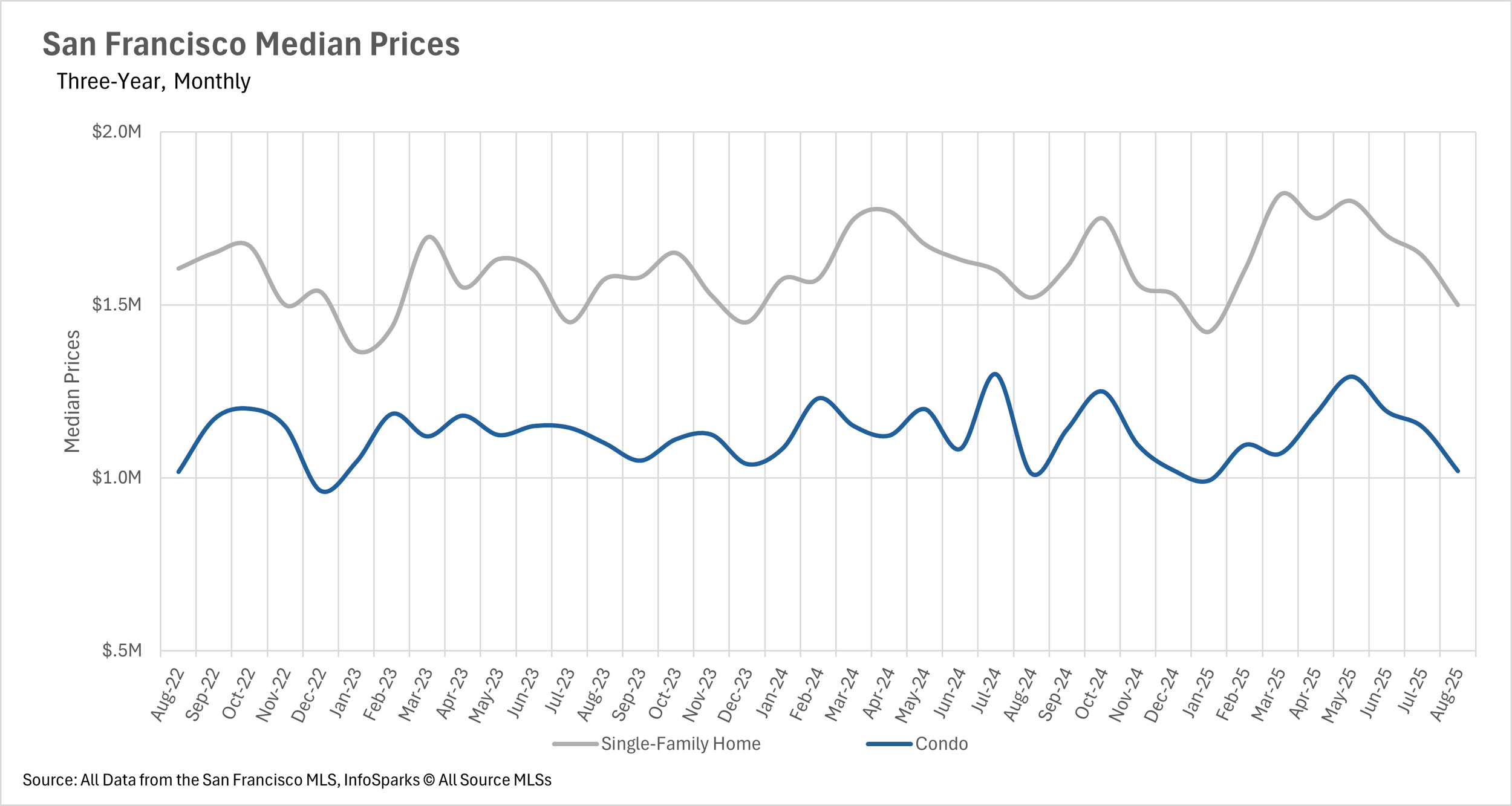

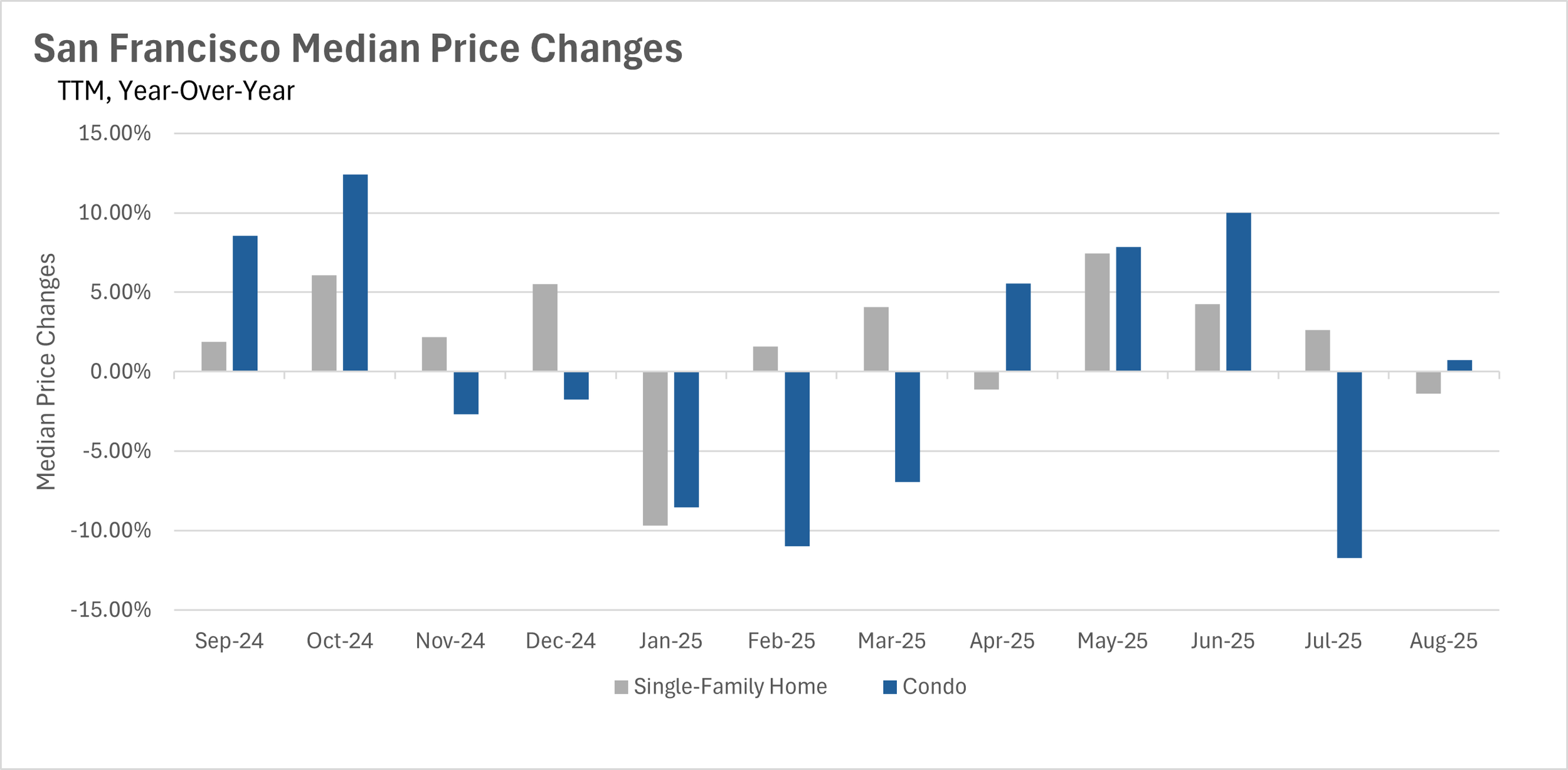

San Francisco’s housing market took a rare pause in August. Sales were basically flat with single-family homes down 1.38% year over year and condos up 0.74%, a notable shift from the 2-3%+ swings we’ve grown used to. The pricing split between product types remains clear: homes are still getting bid up (closing on average at 111.9% of original list), while condos are clearing closer to ask (97.3%). That points to stronger, urgency-driven demand for move-in-ready houses and more selective, value-oriented buying in the condo stack.

Under the surface, supply keeps edging down in both segments, which helps support prices even as buyers stay rate-sensitive. Fewer new listings means well-priced, well-presented single-family homes still draw multiple offers, while condos, facing more competition, are spending longer on the market than a year ago. The result is a market that’s tighter but calmer: not surging, not sliding, and increasingly dependent on micro-factors like block, light, outdoor space, parking, and HOA profile.

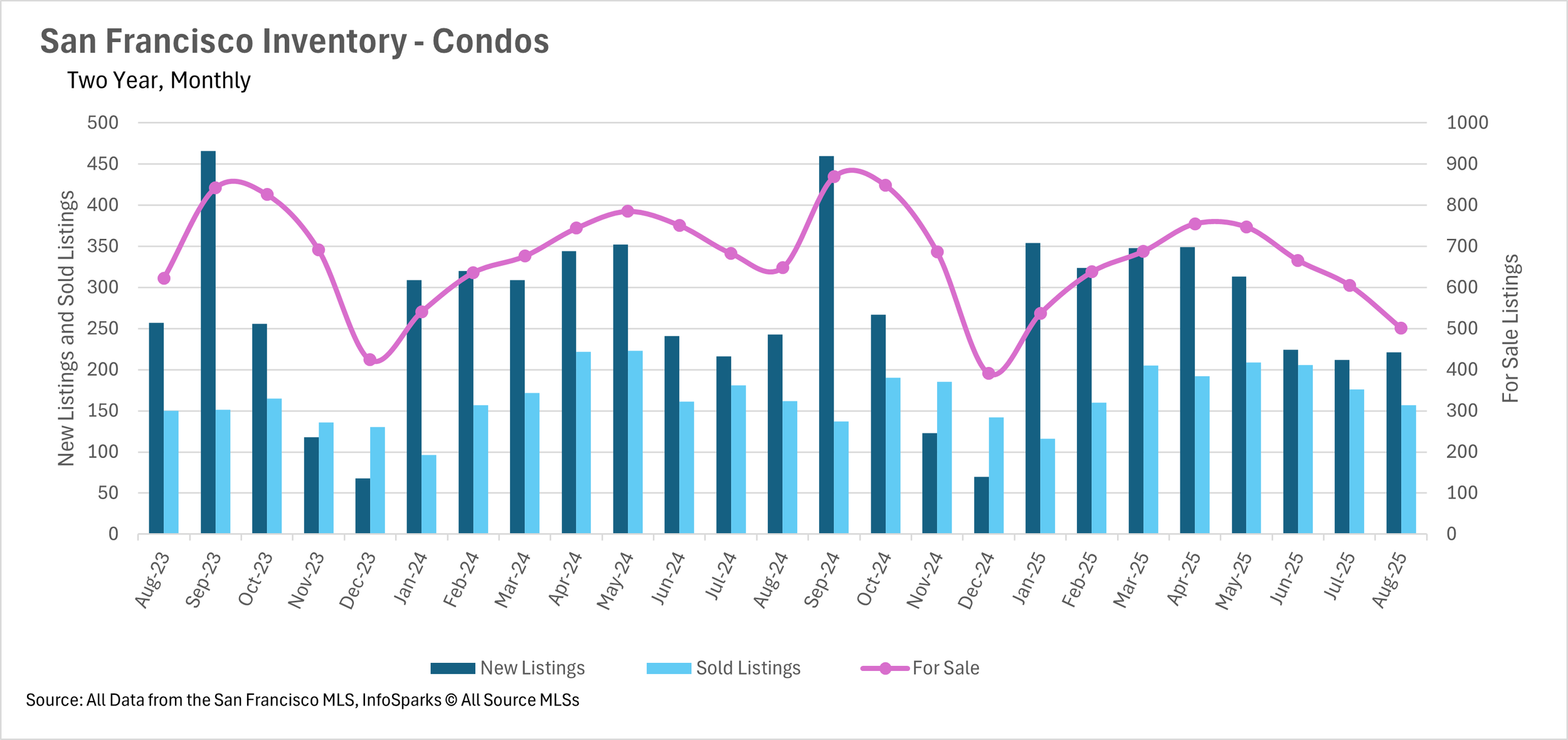

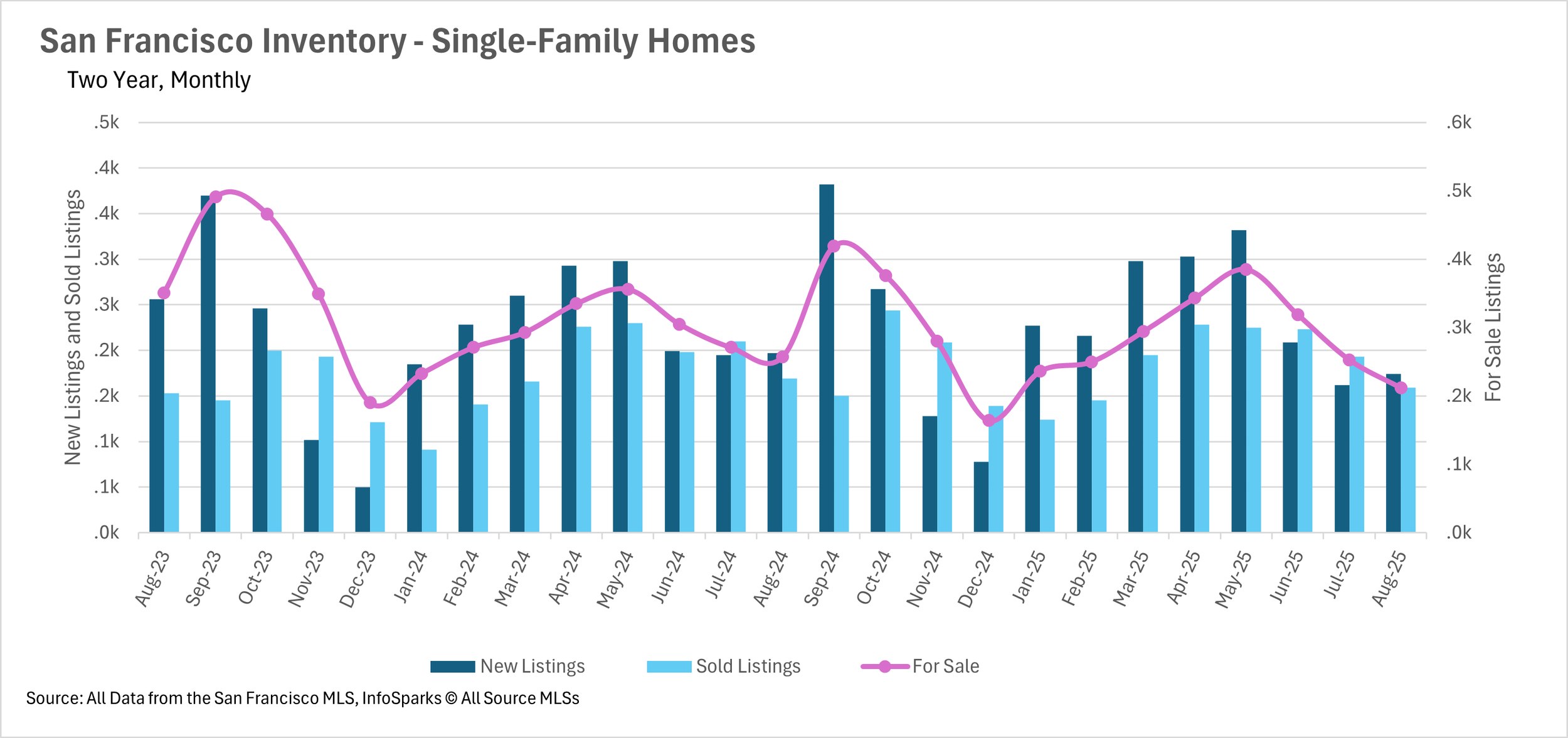

San Francisco’s inventory crunch isn’t new, and it deepened in August. While other Bay Area counties saw listings pile up in spring and early summer, San Francisco moved the other way: active single-family listings fell 17.51% year over year, and condo listings dropped 22.69%. It’s a worsening shortage with no clear relief on the horizon.

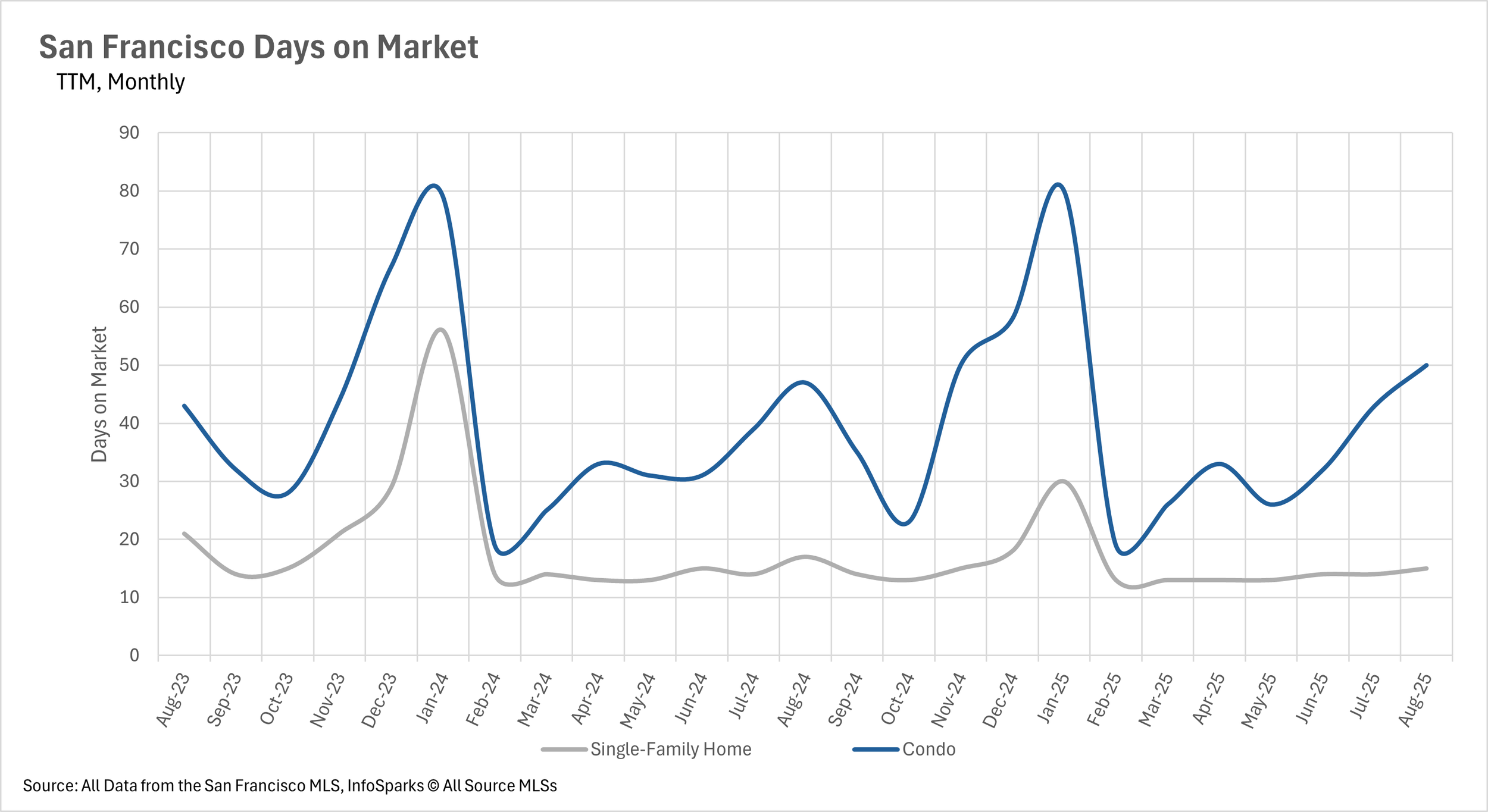

Tight supply doesn’t mean everything flies off the shelf. Single-family homes are moving fast, 15 days on market is the average, while condos are taking their time at 50 days, up 6.38% year over year. Translation: buyers rush for well-priced, move-in ready houses; condo shoppers remain choosier and have a bit more leverage.

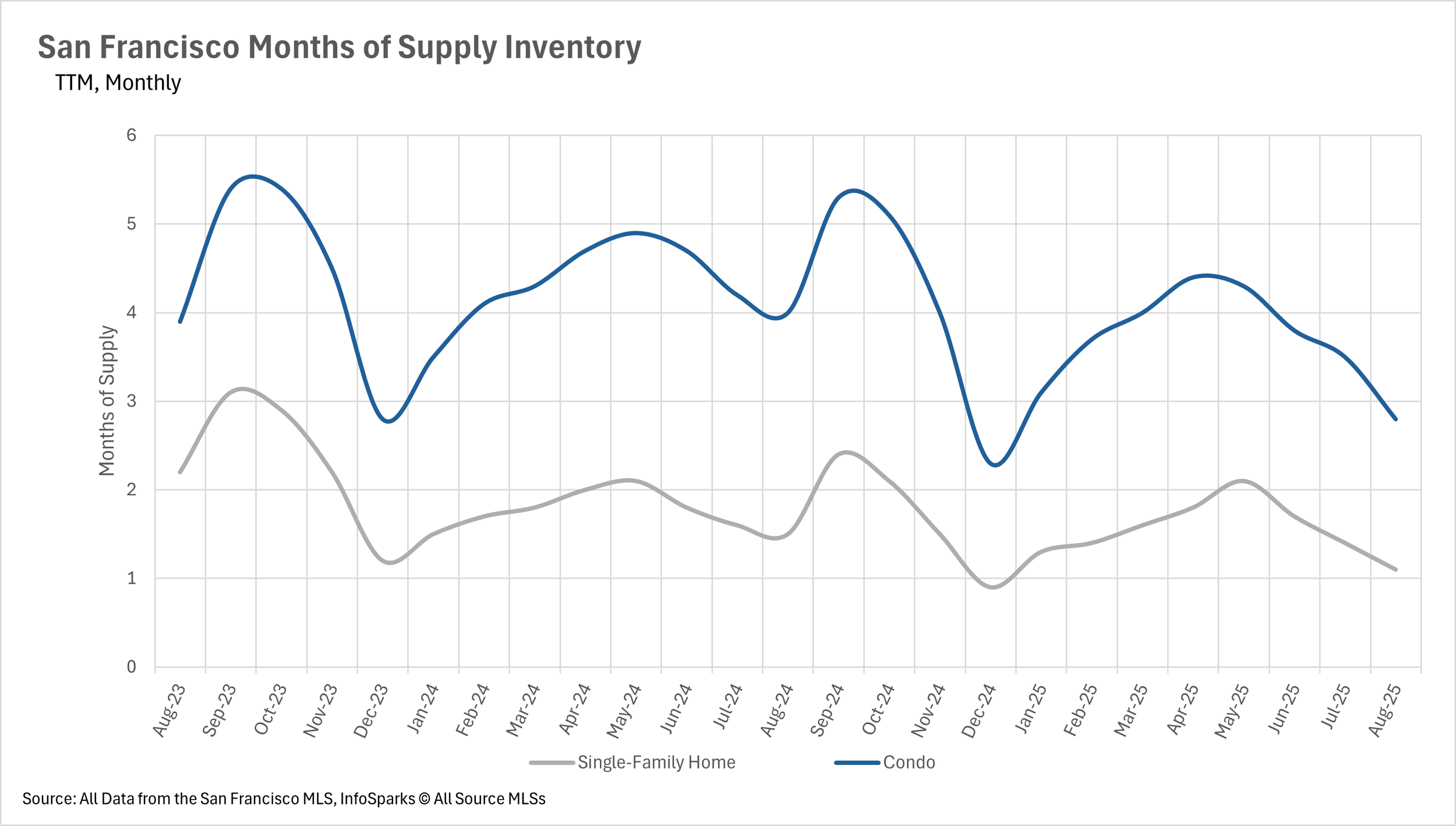

By Months of Supply of Inventory (MSI), balance is approximately 3 months. San Francisco is nowhere near that. August posted some of the lowest MSI readings on record: only 1.1 months for single-family homes and 2.8 months for condos, both in seller’s-market territory, with houses especially competitive. (NAR, RPR)